This post was originally published on Unovest.

If you are familiar with online investments in mutual funds, you would know about Common Account Number or CAN and how it gets you a single point access to transact online in direct plans of several mutual funds. The CAN is issued by MFU, a mutual fund industry initiative.

In fact, Unovest too uses MFU’s infrastructure at the backend to process online transactions in direct plans.

However, the creation of CAN was a paper based process till now.

The good news is that CAN has now gone electronic. It means that you can now apply and get your CAN online, completely paperless.

Let’s now quickly dive in and create an e-CAN.

How to create an e-CAN or Electronic CAN for an existing mutual fund investor?

Before you can take the online route for your CAN, 3 conditions have to be fulfilled.

- You should have done a regular KYC (and not Aadhar based e-KYC). How do you know if you have one? Go to this link and check out if your KYC is complete.

- You should have an existing investment in one of the Mutual Funds on board with MFU. There are currently 25 of them. See the list here.

- The bank account that you plan to register with your CAN should already be registered with your existing mutual fund investment.

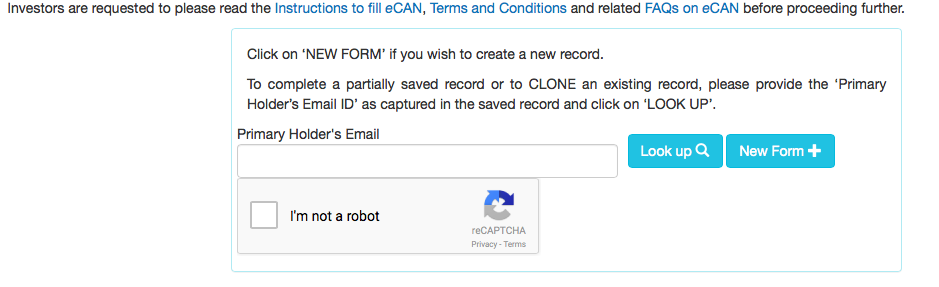

Once the above 3 conditions are fulfilled, you can go ahead and click on this link. You will see a page as below.

- Enter your Email id and click on New Form button. You will then be subsequently taken to the page on mfuindia.com as below.

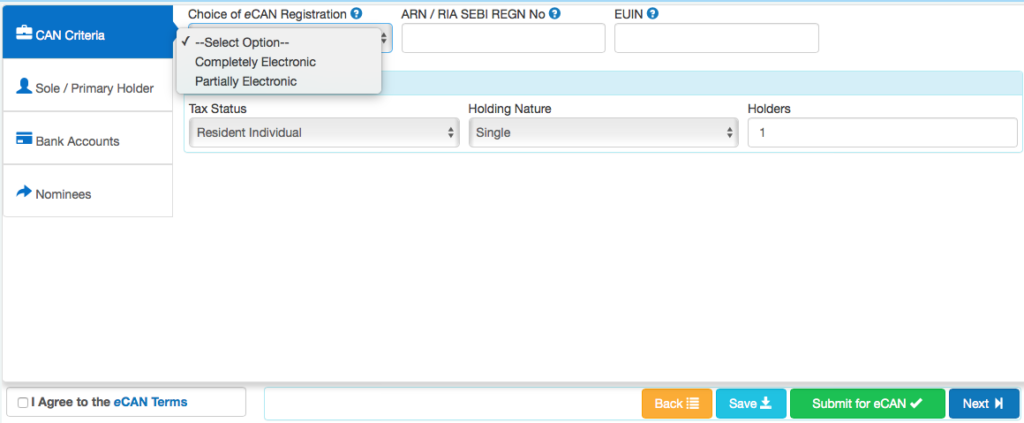

- First select the type of CAN registration. If you fulfil all the above 3 conditions, then select Completely Electronic option.

Do mention the RIA code INA000003643 on the form. This will enable us to interact with MFU to service your needs including any queries/complaints and feedback.

- Then select holding type (Single, Joint, etc.) and enter the number of holders/applicants for the CAN you are creating.

- Fill in the required details related to each of the applicants, their additional KYC details, address, Bank account details and nominee information. Once this is done, you will be then asked to upload your documents for proofs.

After this process is complete you will be allotted a CAN. However, this e-CAN is provisional and subject to verification of your details with the documents you have submitted.

Remember: You can not immediately start to transact online once you get your CAN. In about 2 to 8 working hours, the MFU team will verify all details and confirm your CAN number. You can transact after this confirmation.

That’s it. You have a fully working CAN now. No need to print forms, send them, deal with logistics issues, etc. You can enter this CAN into your FREE Unovest account and start transactions right away.

For more detailed instructions on how to fill an e-CAN form, click here to download the instructional manual.

How to create an e-CAN or Electronic CAN for a NEW mutual fund investor?

So, if you have never invested in mutual funds before, you can still generate an e-CAN. However, 2 conditions have to be fulfilled.

- You should have done a regular KYC (and not Aadhar based e-KYC). How do you know if you have one? Go to this link and check out if your KYC is complete.

- You should NOT have an existing investment in one of the Mutual Funds on board with MFU. There are currently 25 of them. See the list here.

The remaining process remains the same. Click here to start creating your e-CAN

What if you don’t fulfil the above mentioned 3 conditions?

Not to worry. In that case, right on the first screen, select the CAN registration type as Partially Electronic and go ahead to fill other details. You will have to submit physical documents to a Point of Service to enable MFU to confirm the provisional CAN that you are allotted.

For more FAQs about e-CAN, download the document here.

What if your KYC is not done?

Not to worry again. You can also do a regular KYC online. Some of the mutual fund houses such as Birla, Reliance and Quantum have started to provide this service. Based on experience, we would recommend using Quantum Mutual Fund’s service.

Go to at eKYC.quantumamc.com, fill in the required details and then they will schedule a call with you for online verification via a video call.

IMPORTANT: Please understand that when you use a service of any of the providers mentioned above, they can store your personal information for the specified purpose, sometimes even as a part of regulatory requirements. You are advised to use the services at your own discretion.