Talk to any wise person and one learning that you are most likely to take away is that you should tread your path carefully.

And if you hear Charlie Munger, Warren Buffett’s best buddy and partner in Berkshire Hathaway; he puts it like this.

AVOID BIG MISTAKES.

Quite simple.

When it comes to investing, the rule stays the same.

When you are out there to build your portfolio of equity mutual funds, you may not be very lucky all the time to find the best performing funds. But what you can and should is that when you set out to pick your funds, ensure that you avoid the big mistakes.

How do you avoid the big mistakes?

Usually, investors select funds that have delivered the highest returns in the past. That’s the easy bait. But that also akin to entering DANGER ZONE, a sure-shot recipe for disaster.

The only point that should be noted in this regard is:

Mutual fund investments are subject to market risk. Past performance is no guarantee of future performance.

Incidentally, that is also the statutory warning that you will find in every mutual fund advertisement.

As you now understand, performance is a result, not the means. You cannot control returns. What you can control is what drives performance, the factors behind it.

How to select equity mutual funds?

The 3 key parameters you should use while selecting equity mutual funds are:

- Low Expenses – If a fund can’t control its expenses and push them lower over time, it is not doing something right. Funds with high expense ratios should NOT find a place in your portfolio.

- Low Risk – Yes, the fund that can operate at a lower risk and not allow its value to fluctuate a lot is the one that should be preferred. There is a misguided notion that high risk translates into higher returns. Nothing can be further from the truth. Standard Deviation is the measure of risk in a mutual fund. Stick to low risk funds. You will sleep better at night.

- Efficient risk-reward ratio – Yes, when you invest in the market, the risk tags along. You would ideally want that while the risk remains low, the risk also delivers the best reward for you. The term used to represent this ratio is called Sharpe Ratio. Look out for this – the higher the better.

Using a combination of the above parameters would be a good strategy to pick your equity mutual funds.

Every mutual fund website has detailed fact sheets that contain these information. Use it.

Read more: How to (or not to) select mutual funds

‘Avoid big mistakes’ with equity mutual funds

So, do we have some examples of such funds that can be ‘big mistakes’? Of course, we do have.

For the purpose of study and understanding, I have done a small exercise. I have built a list of funds that rank the lowest on the parameters that I just outlined above.

I am sharing the methodology and the top mistakes here with you.

This is the methodology I used.

- I downloaded detailed data on equity mutual funds from Valueresearchonline. The data is as on September 23, 2015. I did not consider funds, which did not have the requisite data.

- All the plans are regular plans – those which result in commission payouts to distributors. The direct plans do not have as much data available yet.

- I also removed those funds, which were ELSS/tax planning variety, Fund of Funds and Sectoral/Thematic kinds.

- Hence, I have considered only Diversified Large-cap, Mid-cap, Small-cap and Multi-cap funds.

- For the purpose of analysis and rankings, I have used 3 parameters, which we outlined earlier in the post – Expense Ratio, Standard Deviation and Sharpe Ratio.

- Expense Ratio and Standard Deviation were given a rank of 1, 2 or 3 based on a range.

- Further individual weights were assigned to each of the three items. The highest weight was assigned to Expense Ratio (I prefer to give it more importance) and the other two, Standard Deviation and Sharpe Ratio, received equal weights of the remaining.

- The weighted average score was calculated for the 3 parameters and the funds were ranked from low to high score.

Note: In this analysis, I have relied completely on the data available. For any reason, if the data is not correct, the results could be questionable too.

The list was finally divided into 2 segments:

- Funds which follow a large-cap, a large-cap + mid-cap or a multicap strategy.

- Funds which follow a mid-cap or a mid-cap + small-cap strategy.

I have taken the lowest 15 ranked from each of the segments and identified them as the “avoid these mistakes” funds.

So, enough of the build-up. Here are the lists.

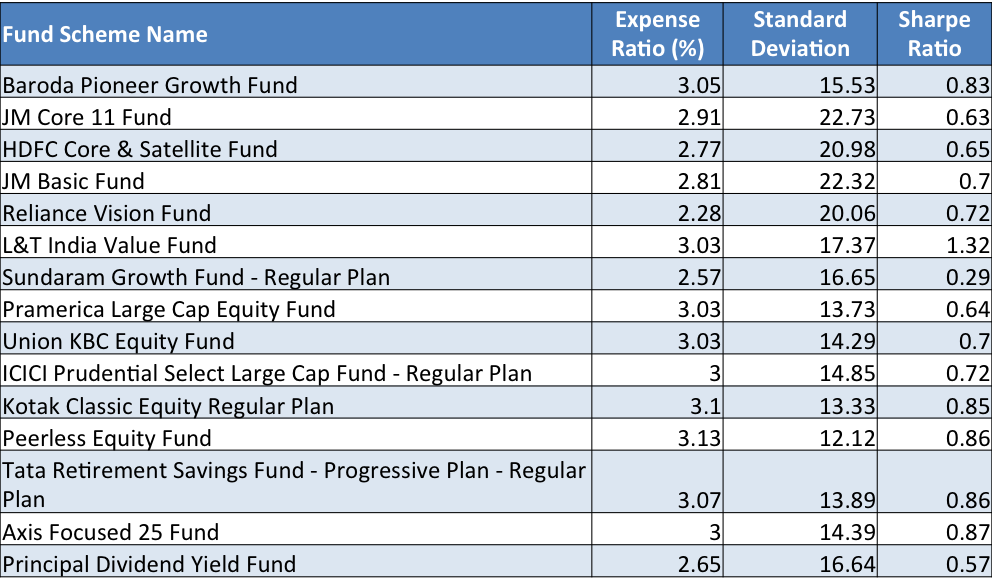

The 15 worst equity mutual funds in Large-cap, Large & Mid-cap segment

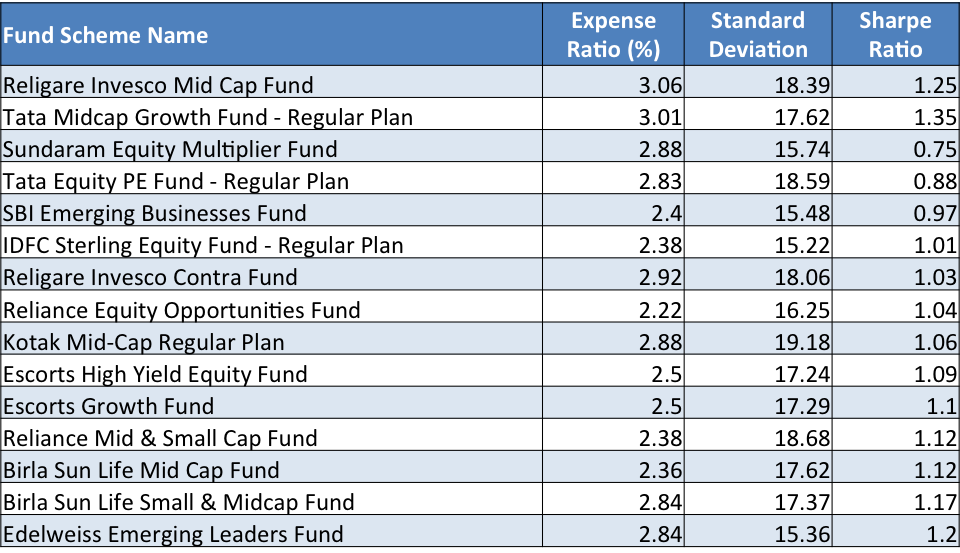

The 15 worst equity mutual funds in Mid-cap, Mid & Small-cap segment

Each of the table above lists the equity mutual fund name along with the Expense Ratio, Standard Deviation and the Sharpe Ratio of the respective fund.

I hope this study triggers a fresh thought process in your minds and a more considered fund selection approach for your portfolio. Yes?

Celebrating the mistakes

The wise learn from their mistakes. Mistakes should not be hidden but accepted and acknowledged and used as an example, so that others can learn too.

For example, Hollywood has the ‘Razzies‘ and Bollywood has the ‘Golden Kela‘ awards to celebrate the worst in the movies.

The mutual fund industry has quite a few awards to celebrate the best. It is time they bring out one to celebrate the mistakes too.

I will dare to suggest a name for these awards: “Ande ka Funda” awards. 😉

Between you and me: Well, have you invested in ‘big mistakes’? Were you planning to? Or you have been smart enough to avoid them? As always, love to know your feedback and questions in the comments.

This is the first time I am reading your blog and find it interesting. Can you please share top 10 performing MFs in mid-cap, small-cap & large-cap categories on my mail id 316296.mukesh@gmail.com

Thanks Mukesh. I do no have any such list as of now. In any case, only looking at performance is not a good idea to select mutual funds. Read the following post: http://www.unovest.co/2015/12/how-not-to-select-mutual-funds/

You may also look at detailed info on mutual funds at smart.unovest.co

This is the first time I am reading your blog and find it very much interesting. Can you please share top performing MFs on my mail id shahvanesh@gmail.com

Thanks Vanesh for the comment. Sent the list to your email. Keep reading!

Dear Vipin,

This is my first visit to your blog and I am quite impressed.Would be grateful if you can share with me the entire short-list of the top performing equity funds as per your methodology-my e-mail ID is “a1sundaram@gmail.com”.Thanks.

Dear Sundaram

Thanks for reading and the comment. You can subscribe to the blog too via email. Just go to the main page and register your email id.

I have sent the mutual fund list to your email id. Regards.

Thanks.Recd the list-shall peruse the same.

Hi, Nice Article. You might have found the best funds as well. Please provide those details as well.

Thanks,

Kanna

Dear Kanna

Thanks for the comment.

I did make an effort to build a equity mutual fund portfolio. Here is the link to the post. https://vipinkhandelwal.com/how-to-build-a-winning-mutual-fund-portfolio-plus-a-sample-portfolio/

In case you need the entire shortlist, send me an email. I will share it with you.

Cheers

Vipin

Hi, this is a good and very sensible article, yes i too would like to view the top performing MF’s, my email id is john@fabhres.com

Thanks John. Have sent you the email. Take care.

Article is theoritical with little practice utility. Risk is not standard deviation but loosing capital and puchasing power. Most people don’t mind paying a bit extra in expense if fund manager is good and returns are higher.

Thanks for the comment Sanjay. You have aptly put the meaning of risk.

Good article! Writing style is amazing, it keeps reader’s interest high even if the subject is complex to understand.

Thanks Umesh. Hope it is useful too.