Investment Decisions Case 1 – Insurance Premium

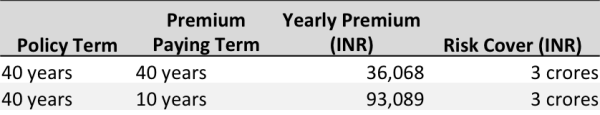

A few weeks ago Rahul, a friend of mine, called up an insurance company to buy a term plan. He wanted a cover of Rs. 3 crores for 40 years.

The agent heard him and said that for a cover of this amount Rahul would have to pay Rs. 36,068 every year as premium.

The agent then told him that he wanted to make another suggestion.

“Yes, tell me.” Rahul was keen to know.

“Sir, I will give you an option where you pay premium for only 10 years but you will get a cover for full 40 years.”

Rahul was excited. This seemed like a bargain.

The agent continued, “The premium in that case would be Rs. 93,089 which you have to pay for only 10 years.”

Rahul first reaction was, “this is expensive, close to 3 times of the regular premium. I don’t think it makes sense.”

“Hear me out, sir”, the agent was confident. “In fact, you will save upto Rs. 5 lac with this option.”

Rahul was still wondering how is this possible?

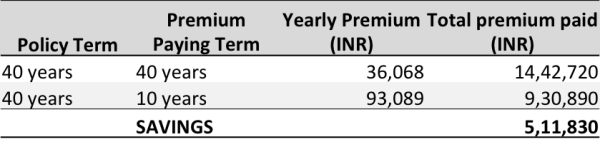

“Sir, when you pay 36,000 for 40 years, you pay close to Rs. 14.5 lacs overall. But when you pay Rs. 93,000 for 10 years, you only pay Rs. 9.3 lacs. The difference between the two is over Rs. 5 lacs. That is your savings.” the agent stopped to take a breath.

Rahul couldn’t believe it. How could he miss a simple calculation like this? It was indeed a huge amount of savings.

But, he wanted to be doubly sure. So he asked the agent to send across an email to him. The agent obliged.

Rahul forwarded me the email and asked my opinion.

I saw the tables in the email and smiled.

Let me ask you. What do you think about this proposition? Which option would you choose – 10 years premium payment or 40 years payment.

While you think about it, let’s take another case.

Investment Decisions Case 2 – Two birds in one shot!

Another friend Siddharth, lives abroad, was visiting India for his vacation. He went to the local bank for some paper work.

After the paper work was done, the sweet lady at the desk asked Sid, “Sir, would you want to know about an investment plan?”

“Yeah, sure. Tell me.” Sid was all ears.

“Sir, you can make a Rs. 5 lac Fixed Deposit with our bank and then every year, we can transfer Rs. 1 lac into a ULIP which invests in the markets. This way you will not enter the market in one go but will spread your investment over the years. ULIPs give you a lot of flexibility and they have also performed well in the past.

As you already know, XYZ company is a market leader in private players and our parent company is a trustworthy name in the financial services space.”

For Sid, nothing seemed to be wrong with the plan. And it was all of Rs. 5 lacs, a relatively small amount. And of course, it was better than the Bank FDs where he had his money lying in so far.

He immediately booked the FD and signed up the papers for the ULIP.

When he returned home, Sid felt something was not right with what he had done. So, first he called up the banker and told her to stop the ULIP application. Then he called me.

I heard him out and explained the basics of a ULIP. He realised what he was upto and felt glad that he didn’t go with the ULIP.

However, I could not help but wonder at the banker’s masterstroke. In one shot, she was about to fulfil her Fixed Deposit as well as ULIP targets.

You see, your bank relationship manager’s job is not just to take care of you with good advice but also to take care of the bank. They have targets to meet for opening new accounts, creating fixed deposits, selling ULIPs, Mutual Funds, etc, which lead to generation of fees to the bank.

You, the customer, is the guinea pig. So, what should you do?

When you have to make investment decisions based on the bank relationship manager’s advice the questions to ask are:

- Can she give you a feature comparison of similar products?

- Why this product and not any other?

- What is the commission the bank will get on the product? One time, recurring?

- Why can’t they take a fee from you for advice and offer you a zero commission product? 🙂

You would know what to ask or do next.

Coming back to our previous case, what choice did you make? 10 years premium payment period or 40 years paying period?

Prima facie, 10 years looks like the right thing to do. A saving of Rs. 5 lacs is very attractive.

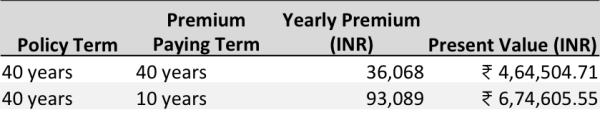

Until – you remind yourself of the concept of the Time Value of Money.

Simply put, a rupee today is more valuable than a rupee tomorrow.

In this particular case, while we know how much amount is to be paid in each of the years, what we don’t know is the value TODAY of all those future payouts?

How do we calculate this present value? By using a simple formula in excel called PV or present value.

Open your excel sheet and in one of the cells, type =PV(rate, nper, pmt, (fv),type).

You will see the 5 input items. This is what they mean.

RATE is the expected return based on which you will discount the future payments to bring them to the present value. Consider it to be the opportunity cost, or what you would have earned in case you had invested the money elsewhere. In this case, we will consider a rate of 8%, typically offered by a Bank Fixed Deposit.

NPER is the number of periods for which the payments are made.

PMT is the payment amount, the premium in this case. This option is used when we calculate present value for a series of regular cash flows.

FV is the future value amount. This option is used when we calculate the value of just 1 cash flow from the future and not a series.

TYPE is representative of the fact whether you the payment is happening at the beginning of the period or end. So, if you are paying the premium at the beginning of every year, you should enter 1, else 0 or leave blank.

Now, when we apply this quick formula to our two premium payment terms, it appears something like this.

- =PV(8%, 40, -36068,,1)

- =PV(8%, 10, -93089,,1)

And the result.

So, which is the more expensive insurance policy? It’s obvious, right!

Simple mathematics has quite a role to play in investment decisions.

From a planning point of view, it is also important to note that when you take a 40 year policy you have an option to discontinue the policy at a later time, when you may not need the cover.

Hopefully, now you have a powerful financial tool in your kit to evaluate your money and investment decisions.

Between you and me: What was your first intuitive response for the choice of premium payment term? Do you know of any other tool that you use to make investment decisions? Do share in the comments.

one more advantage of option I is, let God forbid, but in case of death before 10 yrs., the total out go of paid premiums is less than for option II. very thought provoking.

Ah! Thanks for reading and the feedback, Bharat.

I was thinking of a similar concept — a service charges monthly at Rs. x per month, but offers you a discounted price of Rs. y if you pay per year or quarter. Should you take it? I did not remember the terms present value, future value or discounting, but now that you mentioned it, that’s of course the right one. The formula though looks intimidating at first glance, and the online NPV calculators I found are intimidating at first, too. I wish there were a simple web site that let you enter the monthly payment on one hand, and the annual / quarterly payment on the other hand, and the rate of investment returns, and told you which option to take.

Done Kartick. I believe Unovest will have it.