You have just received a big amount as your annual bonus. While the first temptation was to splurge it all, good sense prevails and you decide to invest 80% of it in equity mutual funds.

But you are not sure how to do it? Should it be one shot lump sum or in parts?

These days what you hear is “Market index touches all time high.” The popular media has this headline all over.

You are now forced to think if this is the right time to invest a lump sum amount in equity mutual funds.

So, you reach out to various forums, blogs, websites and friends who give this advice:

“Do an STP or a Systematic Transfer Plan.”

“Put your money in a liquid fund and then start an STP into the equity fund for 6 to 12 months.”

You feel almost convinced that is the way to go.

Hold on! Why STP at all? Does it really work?

What’s the purpose of STP in a mutual fund?

An STP is a method through which you invest a lump sum money via instalments over a period of time in equities.

Suppose you have to invest in an equity mutual fund but you don’t want to do in one shot. So you invest the lump sum money in a liquid fund of the same fund house and then make an application to transfer a certain amount from this liquid fund to the equity fund at certain defined intervals.

Since markets are typically expected to be volatile, with STP you will distribute your purchase over a period of time at different market levels, hopefully.

As a result, your average purchase price of 1 unit will probably be lower than the purchase price of a lump sum investment. Hence, you are likely to get more units.

Awesome!

Really? Is that true?

Turns out, it is not.

Let’s put this method to test.

STP or Systematic Transfer Plan put to test

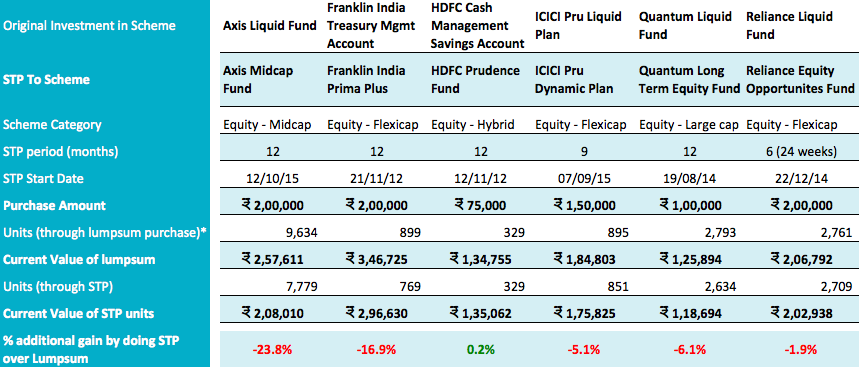

I took investment information of STPs actually carried out and put the numbers in an excel sheet. The summary of it is in the table below.

Note: All investments are in regular plans.

Units and values have been rounded off to zero decimals.

Current value is based on NAV of the respective funds as on August 29, 2016.

As you can see, the investments are in funds across categories including large cap, flexi cap, mid cap and a hybrid fund. So, there is no particular bias based on fund type.

The STPs were done at different time periods in 2012, 2014 and 2015 over 6 to 12 months. In case of 6 months, it was a weekly STP. The others are monthly STPs.

It is assumed that the lump sum investment is made on the first STP date and the units of the equity fund have been calculated based on that day’s NAV.

So, what happened?

While the expectation was that the STP will help you get more units at a lower average price, it actually led to the opposite. You received fewer units in the equity fund with an STP as compared to the lump sum purchase.

Why did that happen? Why did you get fewer units through STP when the expectation was to get more units by taking benefit of market movements?

Quite obviously, the market did not enforce the logic that you wanted it to. You believed that the markets are at a high and they would probably come down or be very volatile and your investment would benefit from this volatility. By staggering your investment, you thought you would be able to buy more units at different price points.

The fact is markets are no one’s slave. They have their own mind or may be no mind.

The verdict is clear

It is obvious that an STP as a method of investment has failed to generate any additional value for the investor. On the contrary, it has led to a loss of profit for the investor – as high as 23.8% in the Axis Mid cap Fund.

With the STP in Franklin Prima Plus Fund, the investor has received reduced gains by almost 17%. That is his loss of profit by not investing lump sum.

The only STP that offers some solace to the investor is the one in the hybrid equity fund, HDFC Prudence. The investor is better off by 0.2% in this STP investment vis-a-vis the lump sum.

The question that deserves attention though is “was the effort for the 0.2% extra gain worth it?”

Attempts to capture market highs and lows fail. The market may not work as you intend it to. The examples used above leave no doubt.

What is clear is that a one shot lump sum investment should be preferred over an STP.

Is a systematic transfer plan or STP not useful at all?

Honestly, I don’t think so. Do you have a view? Has STP worked for you, consistently?

Do share your experience.

Disclaimer: The scheme names mentioned in the post are for information and education purpose only. Please do not accept them as any form of recommendation or advice.

I agree with Vipin. STPs are a bad idea for this purpose. If you have a lumpsum and want to invest it in equity, do so at once.

There’s actually a logical reason why a one-time investment is better. Equity on average gives higher returns than debt. So, if you do an STP, your money is sitting in a low-return fund for a while before going to a high-return fund. That doesn’t make sense. Put it in equity ASAP so that it earns a higher return for you from day one.

Even if a decline does happen, if you’re a long-term investor, you’ll almost certainly make it back later. And, if you’re worried about a market decline, that can happen after you’ve finished your STP.

Thanks for adding to the discussion Kartick.

STP according to me gives more relaxed way of Investment journey. There may be difference in returns during various market cycles. During bull market STP may not be a good option. However , to have a safe journey STP is better. Volatility is natural phenomenon. STP helps during sharp fall. For Eg. STP from Jan 2008 to May 2009… STP in 2010-11 STP from April 2013 to March 2014. STP is flexible. Investor Can stop STP when market valuation becomes expensive. You have a option to switch more money in target fund when there is sharp fall. Thanks for this article. I also liked the points discussed in comments section.

Thanks for reading and making the comment Andrew.

Vipin,

One of the reasons why experts advise people to go for STP instead of lumpsum is the psychological factor. If you invest a lumpsum and market goes down 50% in the next couple of months, you will regret your investment for a period of time until when it comes back up. If you don’t regret your investment, then you will surely regret lack of lumpsum to invest in the downturn that followed your investment.

So not every investment decision is taken based only on returns and not many in our country are strong enough to absorb market shocks.

Meanwhile, did you calculate the liquid fund/ultra short term fund returns during the STP? It can give you 8-9% for six months or more and can make a decent difference.

Good point Pradeep. 🙂

What has been your own experience with STP?

Yes, glad you asked about dividends / gains on liquid funds. The gains have been adjusted in terms of additional units in the equity fund. Just to clarify 8-9% is per annum.

Thanks for the comment.

Vipin,

Personally if given a chance I will always go for STP and I will do that only because of a chance that the market may tank tomorrow. Its better to play safe when it comes to equity investments even if its for long term. The return calculations need not be done immediately after the STP is complete (or 3 years after that), it should be done only when we redeem it after 10 years or 20 years. I am sure the differences will fade out after such a long time frame.

When you decide to go with lumpsum today and say the NIFTY is up by 120 points by 2.30 PM, you will surely want to think twice whether to put the money today or wait for a couple of days to see if you get a bit of dip.

Also if you ask people in a rising market whether they would prefer lumpsum or STP, they will go for lumpsum because of the euphoria of rising market.

But if you ask the same question in a falling market, the answer would be STP because of the fear of more falls and all that.

So the STP vs Lumpsum argument has more of emotional factors to it than the gains, this is my personal opinion.

Appreciate your viewpoint Pradeep. Thanks for sharing.

Liquid funds would give you 8 to 9% annualised return and not more six months period.

It makes further immense sense to have STP routed through a liquid fund to earn 8 to 9% extra overeall return v/s money lying in savings bank a/c earning only 4%.

Secondly when you put money in liquid fund, you have a psychology not to tamper with that money and keep it over there for earmarked investment. Rather than in a SB a/c, where you tend to withdraw for any defined/undefined purpose.

SIPs and STPs don’t work as expected in the bull market when the market is rising. They work when the market moves both ways. As you have taken shorter durations, you may not see the benefits of it.. STP is nothing but SIP only with the source being a liquid/debt fund.

So in a way you are concluding that SIP is not beneficial…. if you consider long term then they will work whereas if you consider shorter time frames they may not work..

Regarding your question “Has STP worked for you, consistently?”.. Nothing is consistent in the market.. even lumpsum will fall when market takes downturn.. does that mean lumpsum is not beneficial then?

Dear Charan

Thanks for the comment.

SIP and STP is about cash flows. In case of STP, you have a cash flow available in advance.

In SIP, the cash flows happen in regular intervals and you design you investment method accordingly.

The question is that when investors attempt something like this (STP vs lumpsum) what did they actually end up with?

That’s what has been tried to be pointed out through this post.

Hi Vipin Sir,

I would like to share some important points here regarding lumpsum investing vs STPs:

1. All those experts who keep predicting market like valuations are high now etc etc and now markets are on peak and hence will fall, no body can predict markets as their raise or fall depends on global and domestic factors, hence, you cannot predict the markets and my final conclusion is that one cannot time markets.

2. The day when Britain decided to exit EU, sensex crashed over 600 points and all market experts predicted global crisis, but, opposite became true as Indian markets started to rise post Brexit contrary to views of experts.

3. Some analysts are also saying since 2014 that Deustche Bank will crash and hence eventually global markets will crash as well and they were predicting 10 times crisis compared to Lehman crisis but markets did not crash till date as predicted by analysts.

4. My personal experience proved that lumpsum investing is better than STP for 6 to 12 months as I invested in 5 hybrid equity balanced funds for an amount of 12 lakhs on 1st January 2016 when markets were all time high, but, immediately after I invested, markets started to fall with some corrections for few months and my portfolio was down by 1.5 lakhs versus my investment at some point but now my portfolio is up by 1.2 lakhs where there is an appreciation of 14% till date, some people even suggested me to go for STP over 6 to 12 months to average out but I believed in this lumpsum investing than STP as I did not need this anount for upto 5 years.

5. If you have a sufficiently long time horizon, lumpsum investment works best and if you want to follow value investing approach by entering into markets based on lower P/E ratio, then , this is for short term stock trading as always you will end up buying when NAV is lower and exit when NAV will be all time high based on P/E ratio.

6. Always there is no rught time to enter or exit markets, enter when you will have money in your hands and exit once you will reach your goal.

Thanks.

Regards,

Bhaskar Nimmala

Your point No. 4 : That’s exactly the crux of my comment. You cannot have a fair analysis for a short period of 6 months or even 1 year. For short term, one may/may not go for lumpsum investment and that’s perfectly left to an individual choice or decision. Analysis cannot point to a conclusive hypothesis or theory. And therefore, one cannot make a headline saying “Systematic Transfer Plan, STP in a mutual fund- Is it worth it?” because the headline conveys an erroneous interpretation and meaning to the readers.

No one predict the market. No one has done it. And no one will be able to do it. Period. The world will collapse if some one is able to predict the market or future. More than half the people will lose their job in such a scenario. Uncertainty thrives individual and the market.

What we always about is some lead/lag indicators (which may a very simple one like TTM/current P/E or a very complex model) and then we theorise based upon the model which we use and that there are enough empirical studies done on the same thing which help you to come to a reasonable conclusion about the findings of your theory/hypothesis.

And again, whether you got 14% in flat 6 to 7 months by lumpsum investment is, may be your luck because simply you did not put any analytical model to your investment before making investment decision.

But again.

Leave this discussion to rest now.

Good luck to all those people who invested for a short period of 6 to 7 months and made 14%.

Great points Bhaskar. Thank you.

One of the things I wish to clarify about the post is – it takes actual investment decisions made by individuals and how they did not work. It’s not a simulation. Not once or twice but several times.

The purpose is to point out to investors the flaw in the thinking process. As the article says, the market does not do your bidding. It has its own mind or no mind. Any attempt to play it logically even with methods like STP are unlikely to yield a result that one hopes for.

I agree with you Vipin, I indeed started SIP though there is a lump sum available in Oct 2015.

This route initially worked as markets were down by Feb but then recovered and the lumpsum value would be more than the SIP route.

I don’t agree with the other comments as markets generally spend more time in bull phase though bear markets are more harsh but shorter in time.

Thanks Gopal for reading and the comment. Your observation is relevant.

I think the whole narrative and conclusion is erroneous.

1. It is wrong to take a very small period of 6 to 12 months of SIP/STP. In a rising market, through SIP/STP, you will get/purchase less units than otherwise through a lumpsum purchase at the start of the SIP/STP period. One must take a minimum of 3 years and beyond to draw a fair conclusion.

2. Always comparison has to be made with the benchmark index and not v/s other methodology of investment for the same investment period.

My above first view is fundamental flaw in the entire analysis and second is a tactical/technical flaw in the above analysis/post.

Thanks for the comment Sir.

Just to clarify the post takes data from what is practiced by investors actually. There are no assumptions made except that if lumpsum was done instead of an STP.

Would you have done an STP yourself or known someone who has done it and got better results? Do share the experience. I am looking for more real data points.

Didn’t understand your point about comparison with benchmark index vs other methodology of investment?